R&D Cash and Tax Incentives

R&D tax relief is a UK government incentive that has been around since 2000. It aims to promote innovation, create jobs in the UK and attract foreign direct investment. Most people typically associate the words “research and development” with scientists in white lab coats or high-end engineers developing the latest ground-breaking technologies. However, the scheme has a much broader scope, covering industries as diverse as dentistry, waste management, and food and beverage. Your company may be eligible to claim R&D without even knowing it.

How can my company benefit?

The merged scheme R&D expenditure credit ( RDEC ) and enhanced R&D intensive support ( ERIS ) replace the old RDEC and small and medium-sized enterprise ( SME ) schemes for accounting periods beginning on or after 1 April 2024. This new regime aims to simplify the R&D tax relief process and provide better support for R&D-intensive SMEs.

The merged RDEC regime offers a 20% tax credit on qualifying R&D expenditure. For loss-making companies, the net benefit is up to 16.2% per qualifying R&D pound, while for profitable companies, it’s 15%.

To qualify for ERIS, a SME company’s R&D expenditure must be at least 30% of its total expenditure. Loss-making SMEs can deduct an extra 86% of their qualifying costs, making a total of 186% deduction, and claim a payable tax credit worth up to 14.5% of the surrenderable loss

For accounting periods starting prior to the 1st April 2024, companies can still claim under the previous two R&D schemes – the SME scheme and the Large Company scheme.

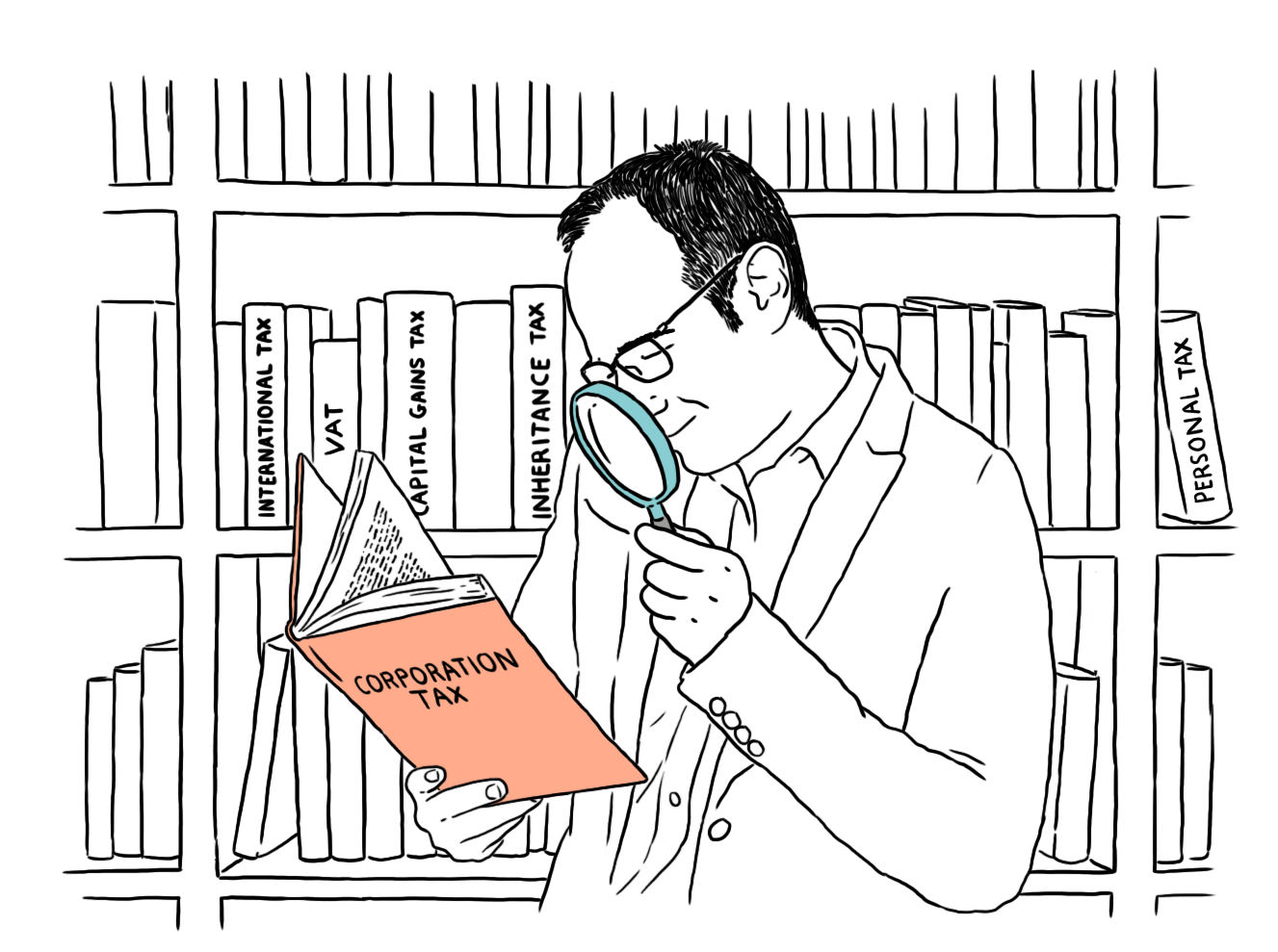

What are the qualifying criteria?

- Your entity needs to be filing a corporation tax return in the UK but does not need to be paying corporation tax – loss making companies can still benefit;

- You need to be engaged in a field of science or technology – this covers a broad range of activities;

- You need to be seeking an advance in your field – this means seeking to establish new knowledge or capability in science or technology;

- In the process of seeking this advance your company should be seeking to overcome technological or scientific uncertainty – a good indicator of this is that several iterations are required in your attempts to solve a problem. The problem does not need to be resolved in the relevant accounting period you are claiming for and a failed project based on technical complexity is actually a good indicator of R&D taking place.

What type of costs qualify?

Can I claim retrospectively?

Yes, a company can file a claim up to two years after the end of a relevant accounting period.

How can GKA Innovation help?

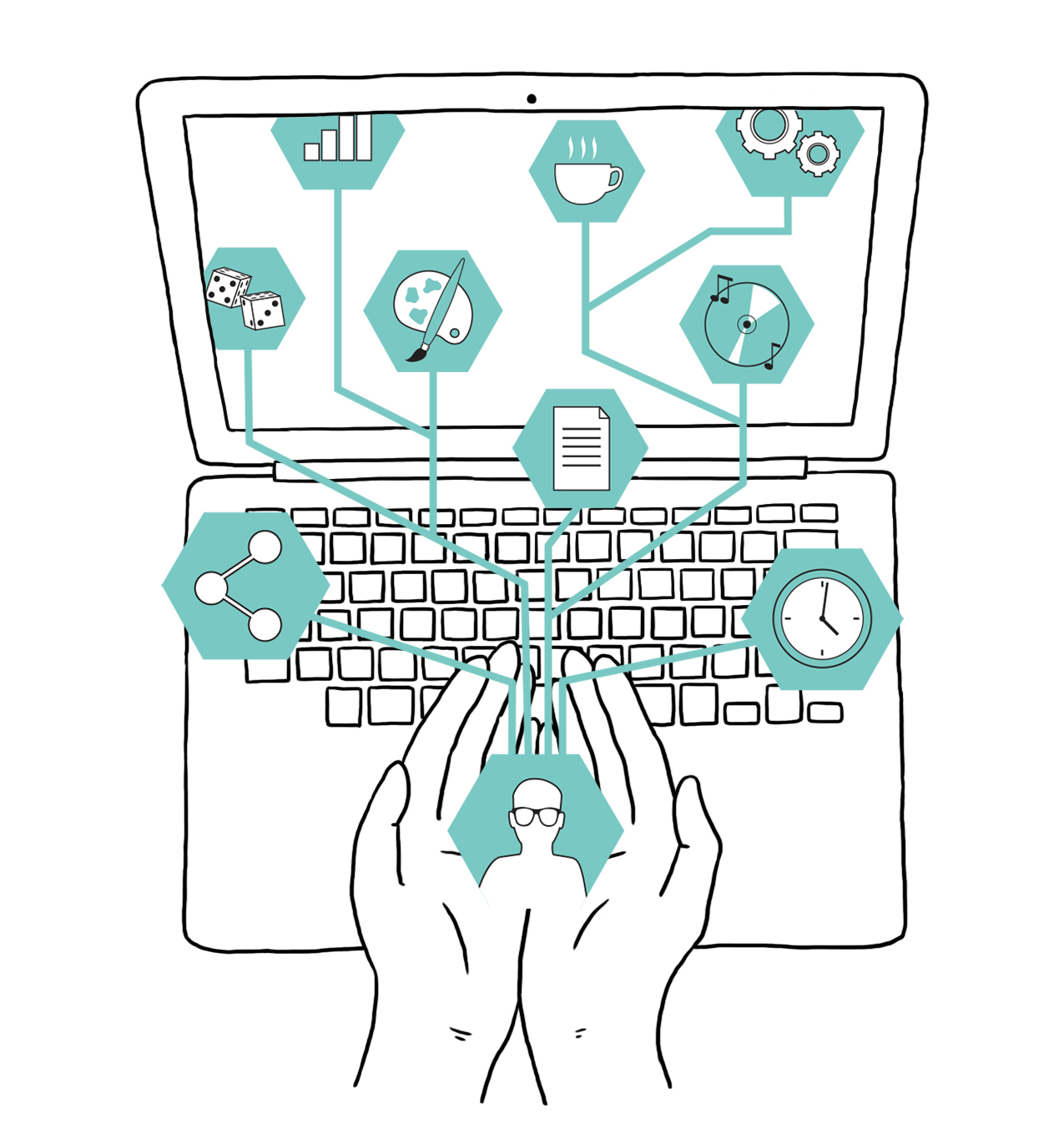

GKA’s unique team of industry-experienced PhD’s and chartered accountants can extract the nuggets of R&D from your regular business activities in a streamlined hassle-free manner. As experts in the field, we can maximise your claim relative to other providers/accountants and have never had a claim rejected.

We do the hard work, minimise form filling (e.g. payroll processing and questionnaire templates) and gather technical information through our educational industry-focused on-site workshops so you can focus on running your business.

We provide support throughout your whole innovation lifecycle, not simply supporting in your R&D tax claims, but assisting with publication reviews, patent and grant applications as well as providing you access to our innovation hub where you can meet and collaborate with like-minded colleagues in your industry to facilitate your businesses innovation.

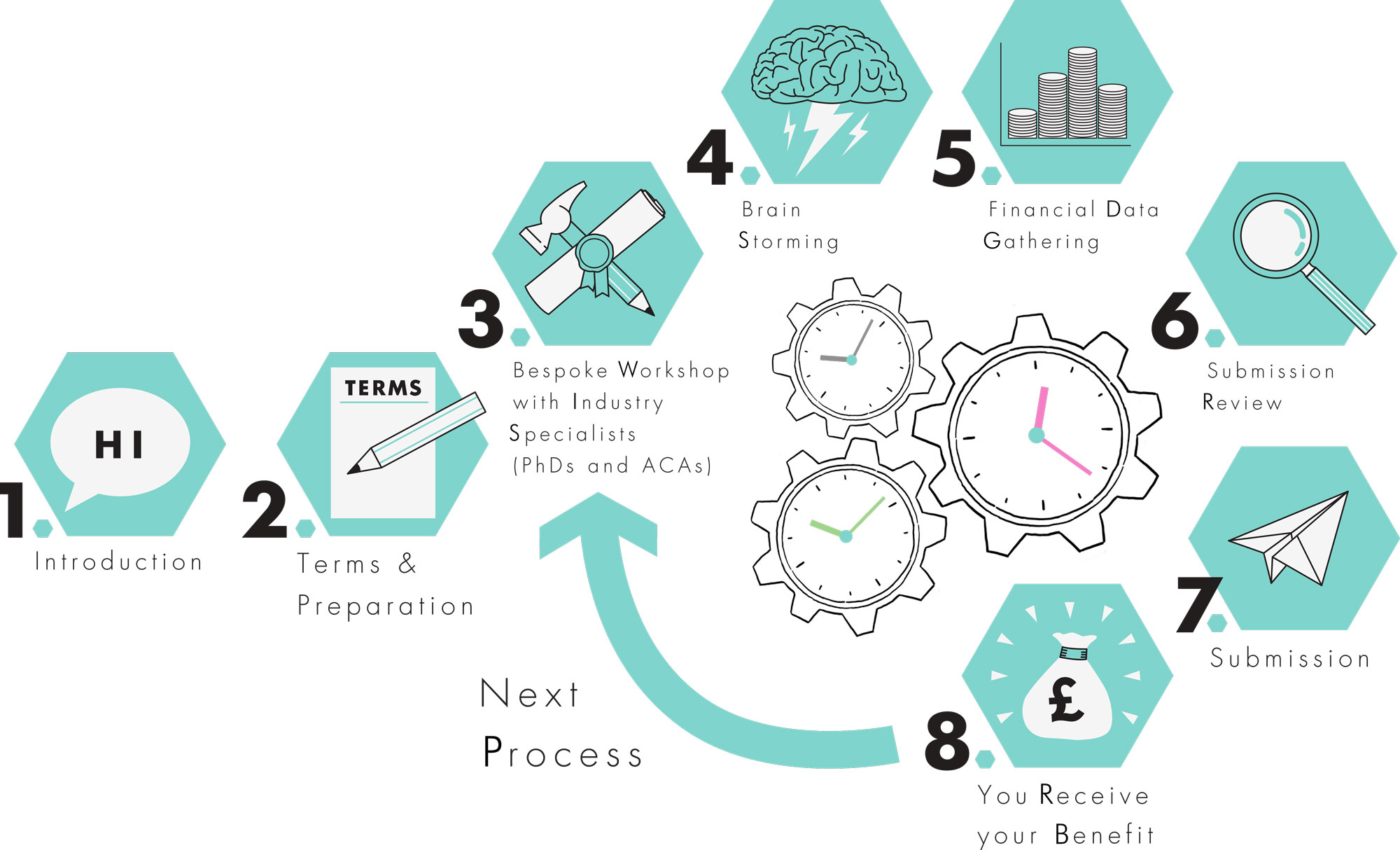

How We Operate