Patents and Related Benefits

Patent Box Tax Relief

Patent Box tax relief is an innovation incentive which was introduced in 2013 in order to promote the commercialisation of Intellectual Property in the UK. It is available to companies with Qualifying IP rights (patents or exclusive licences) and allows them to reduce their corporation tax rate on any profits from patented/exclusively licensed products or processes.

How can my company benefit?

Your company can receive approximately £9 in benefit for every £100 of relevant IP profit which GKA identifies – this is achieved by reducing the corporation tax rate for relevant IP profits from the normal corporation tax rate to a special rate of 10%.

If a larger product contains a patented or exclusively licensed component, then the sale of the entire product can qualify – for example, the sale of an entire car could qualify for Patent Box relief by virtue of having a critical patented engine component. In such situations, Patent Box tax relief can be especially lucrative.

What are the qualifying criteria?

There are three qualifying criteria:

- Your company must own a Qualifying IP right – this can be an active/pending UK or European patent, or an exclusive license related to such a patent, if the patent is owned by a company in the same group;

- Your company must have undertaken qualifying development in relation to the patent or, if claiming for an exclusive licence, the patent could be developed by a company in the same group and actively managed by the exclusive licensee;

- Your company must be generating revenue from the patent or exclusive license – this can be in the form of sales, royalties, proceeds from IP disposals, or infringement claims.

Can my company claim both Patent Box and R&D?

Of course – the R&D deduction is simply applied after the Patent Box deduction.

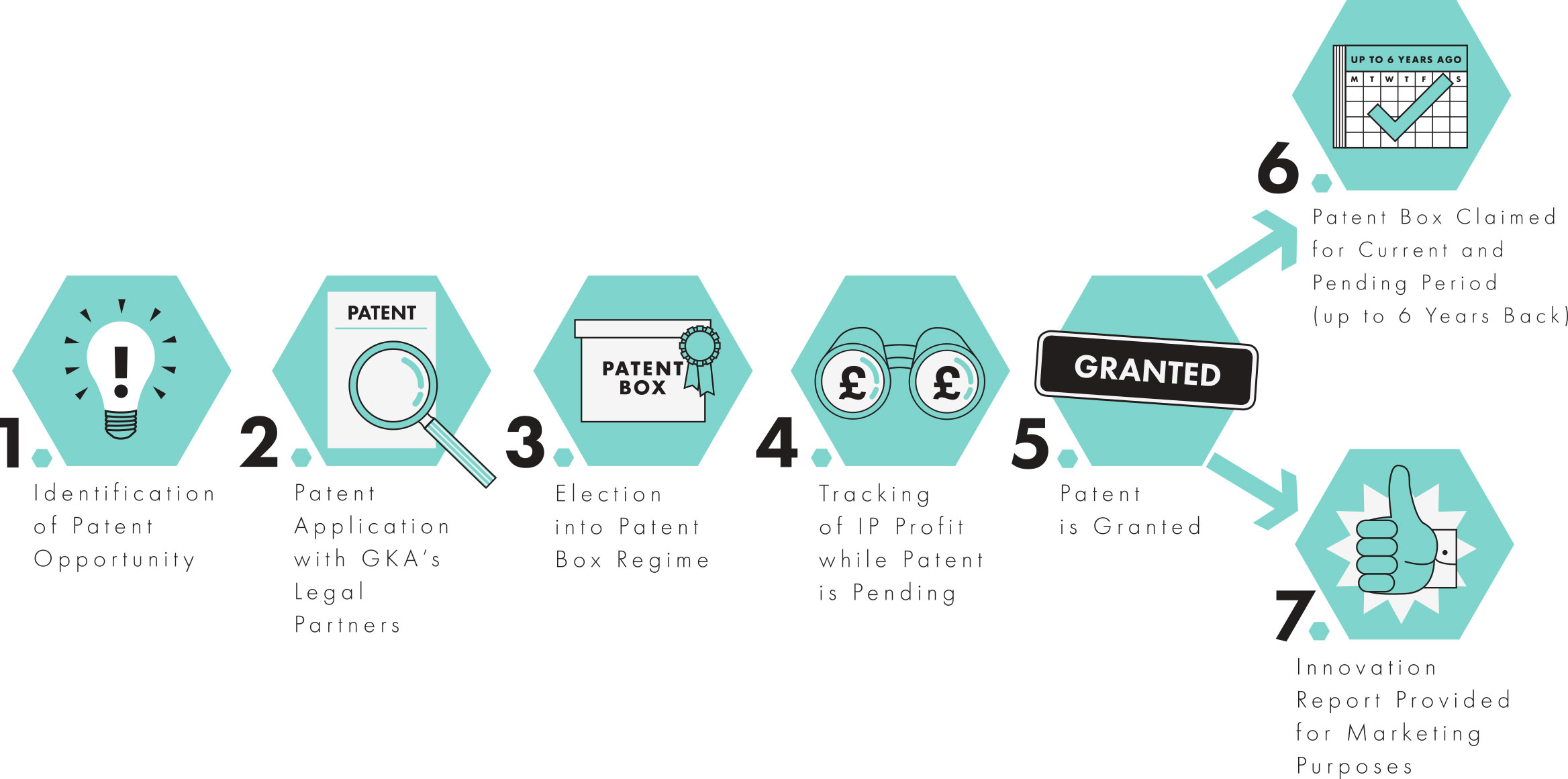

Can I claim retrospectively?

Yes – for active patents a company can file a claim up to two years after the end of a relevant accounting period.

In the case of a pending patent, if a company opts into the scheme early it can claim for relevant IP profits up to six years retrospectively, once the patent becomes active.

How can GKA Innovation help?

Using our industry expertise, we will advise you on how to maximise your relevant IP profits by increasing the proportion of sales with patented/exclusively licensed components. We provide a comprehensive report to support your claim and have never had a claim rejected.

Moreover, we can help your company with adapting to the new rules including mandatory streaming for new IP created on or after 1 July 2016 as well as the Nexus Fraction, which could reduce the benefit for certain companies which outsource their development.

Finally, we offer a Fully-Integrated Patent Package – we work hand in hand with patent lawyers who can help you register and protect any new IP, allowing you to benefit more quickly and efficiently.